If you are receiving Jobseeker's Benefit because you are in 'systematic short-time employment', then you do not pay Income Tax on the benefit. Jobseeker's Benefit (self-employed) The Jobseeker's Benefit (self-employed) payment scheme commenced on 1 November 2019 after it was announced in Budget 2019.. Income in America is taxed by the federal government, most state governments and many local governments. The federal income tax system is progressive, so the rate of taxation increases as income increases. Marginal tax rates range from 10% to 37%. Enter your financial details to calculate your taxes. Household Income.

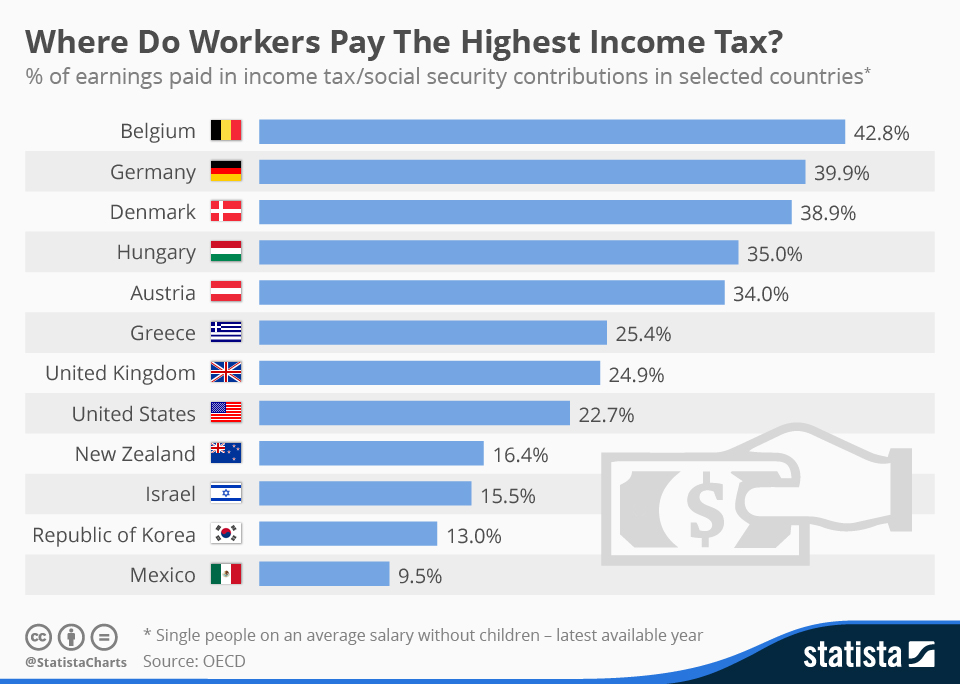

Chart Where Do Workers Pay The Highest Tax? Statista

How Much Tax Does a Self Employed Person Pay? Randolph Law Firm

How much tax do I pay on 401k withdrawal? YouTube

Tax Explained How much tax should I pay?

How Much Tax Should I Pay On 31st January? YouTube

How much UK tax should you put aside if you're employed and selfemployed at the same time? Here

How much tax should I pay as a contractor? Reliasys

How Much Does an Employer Pay in Payroll Taxes? Tax Rate

Tax Explained How much tax should I pay?

How to Pay Taxes Quarterly A Simple Tax Guide for the Self Employed

How much tax should you pay in the UK as a selfemployed creative? What if you have a day job

How much tax should I have withheld?

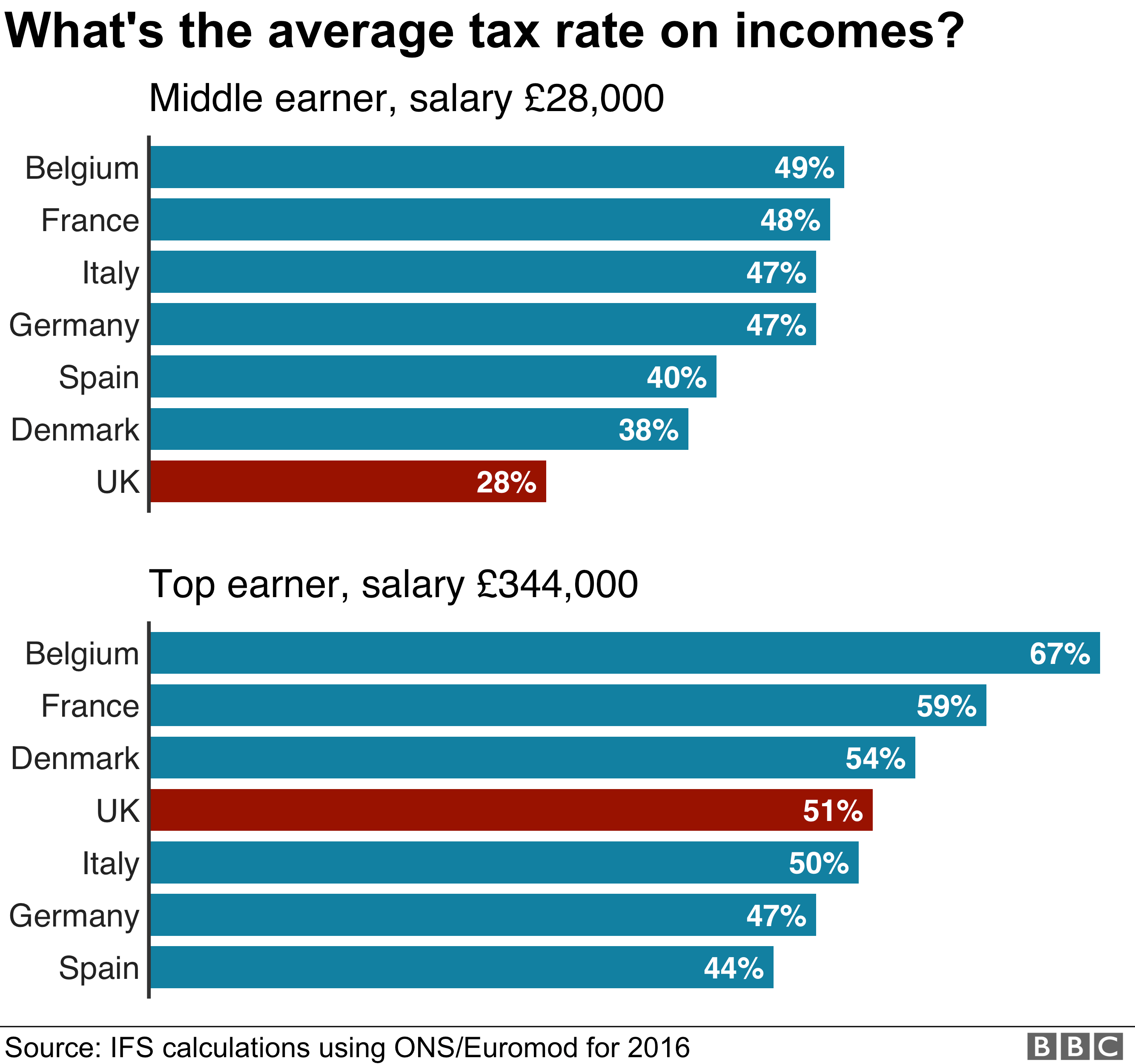

General election 2019 How much tax do British people pay? BBC News

Here's how to find how what tax bracket you're in for 2020 Business Insider Africa

How Much in Taxes Is Taken Out of Your Paycheck? Morningstar

Life of Tax How Much Tax is Paid Over a Lifetime Self.

Budget 201920 Here’s How Much Tax You Will Pay On Your Salary UrduPoint

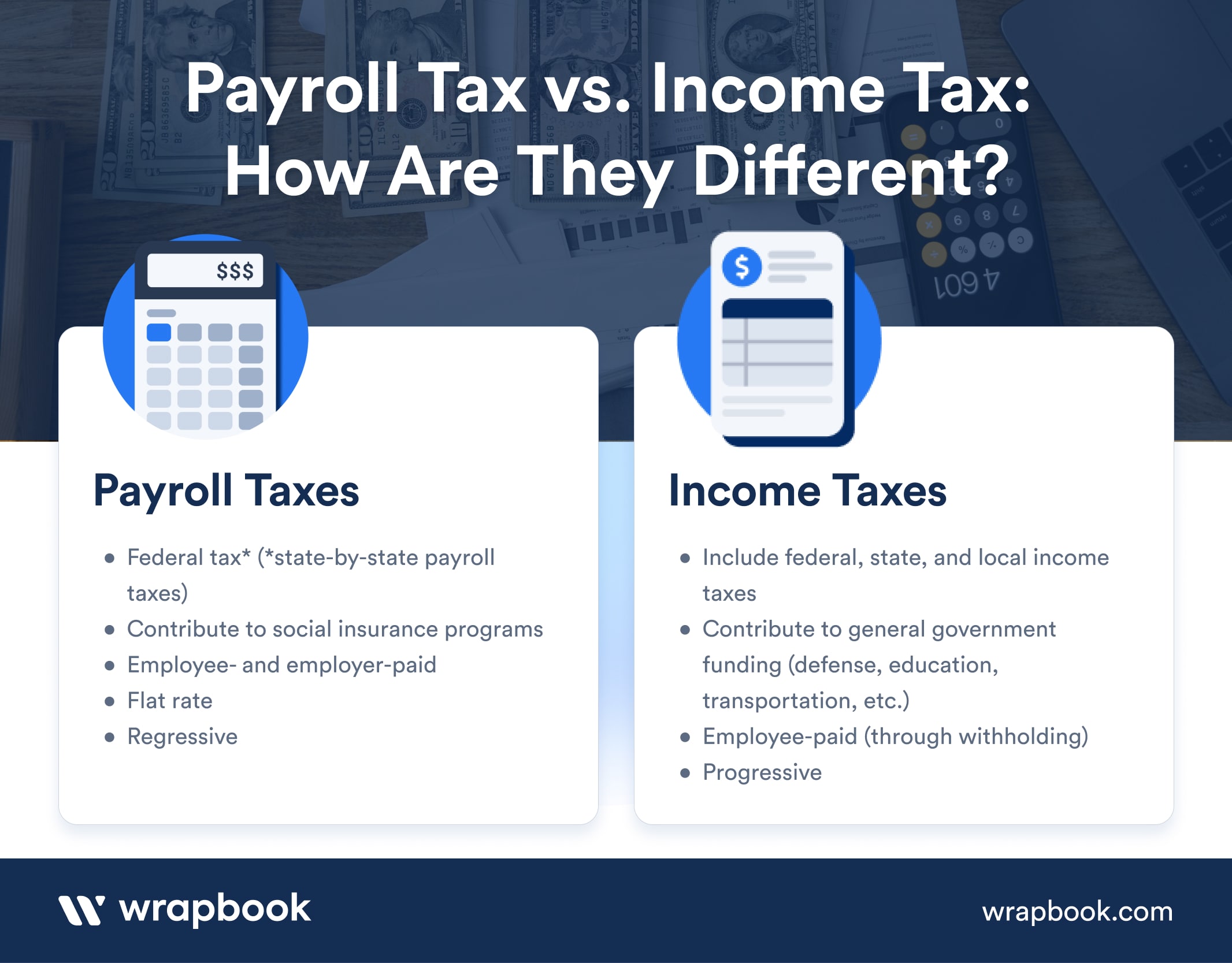

What are Payroll Taxes? An Employer's Guide Wrapbook

2020 federal tax calculator BradyRionach

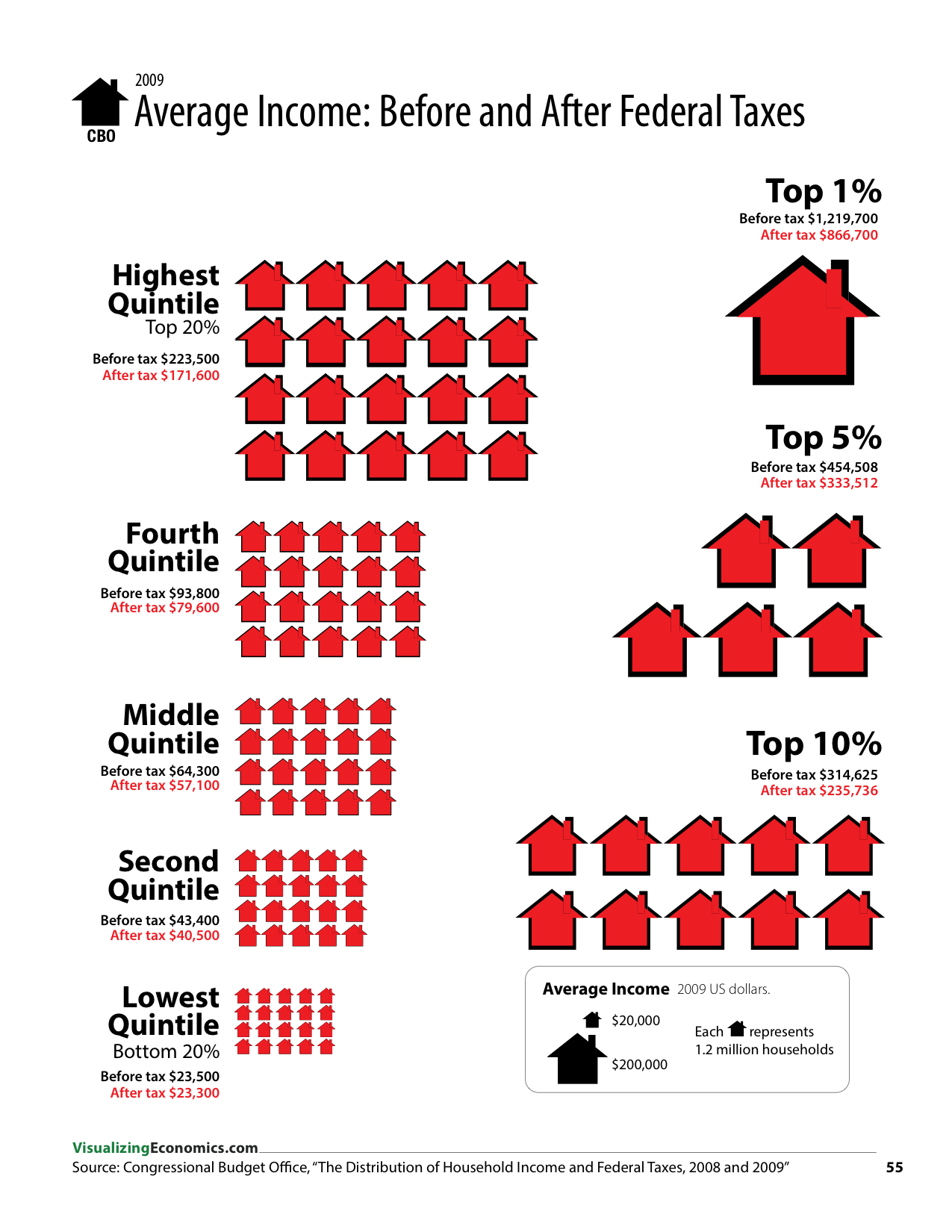

How much do federal taxes redistribute — Visualizing Economics

No. Yes. Page last updated: 20 April 2022. You may have to pay income tax on your taxable Centrelink payments.. Estimate your US federal income tax for 2023, 2022, 2021, 2020, 2019, 2018, 2017, 2016, or 2015 using IRS formulas. The calculator will calculate tax on your taxable income only. Does not include income credits or additional taxes. Does not include self-employment tax for the self-employed.